Glamping and short-term rental numbers have surged in recent years. But how much is too much?

After several years of success renting out his two Airbnb properties near Charlotte, North Carolina, Nick Sullivan was suddenly facing a financial squeeze. As his bookings dropped in the fall of 2022, his revenue was slashed in half and occupancy dropped below 50%.

“We started panicking and started connecting with other folks who we know have short-term rentals,” Sullivan told Business Insider. “We don’t know what’s going on.”

What Sullivan was experiencing almost two years ago was part of a broader trend across the whole nation. During that time, hosts of short-term rentals (STRs) suffered a surprising drop in rent revenue, and people began discussing it online as the “Airbnbust.” That decline is still active across the country, including here in Southern Utah.

The “peer-to-peer” (P2P) marketplace has transformed how services are provided over the last 15 years. While ride-sharing platform Uber (founded in 2009) gave rise to the “gig worker,” Airbnb (founded in 2008) democratized the lodging industry. As lodging development was once only attainable by industry experts with capital to spend, platforms like Airbnb and VRBO allowed regular people to be hosts as well — one rental at a time.

It also exposed these folks to the booms and busts of the business cycle.

Today’s Airbnbust, caused by an oversupply of rental units, is not the first time the lodging market has experienced a disruption. Airbnb was once the disruptor. I remember watching its rise, with wariness and even some annoyance, 10 years ago while I worked as the controller at a hotel management firm. Now, Airbnb has a market cap far exceeding the second largest lodging company, Marriott International.

Since then, there has been more disruption. Experiential lodging has given rise to glamping, now popular along Utah’s national parks corridor. In 2020, Airbnb hosts in urban centers suffered a huge setback when the pandemic permanently shifted guests toward rural stays. 2021 turned out to be Southern Utah’s best year ever for STRs. In some markets such as Brian Head, occupancy nearly doubled.

The Rise of Glamping

On July 11, the Utah Alliance for Economic Development held its quarterly meeting, this time at Ruby’s Inn. There, Garfield County’s Kaden Figgins, in charge of economic development, put together a meeting agenda that allowed for more discussion about the local lodging market.

Hal Feinberg, one of the co-creators of Clear Sky Resorts, talked about market demand for more experiential lodging. He and his partner opened their first property, with 50 geodomes, near Grand Canyon. Currently, their second resort just east of Cannonville is nearing completion and is expected to include 90 geodomes completed after their second phase.

“Stargazing is a big thing,” Feinberg told the audience gathered at Ruby’s. He noted that the resort is next to a top-tier dark sky park, and it’s a great place to stay for people who want the comforts of a hotel but still want to be outside.

In the glamping world, staying in a luxury tent is as cool as sleeping in a geodome. Caitlan Cullen, vice president of Real Estate and Entitlements for Under Canvas, said that travelers first know where they want to visit, and then begin looking for “experiences” to book. More than ever before, traveling is “about making that connection with nature and the community,” Cullen said.

Linz DeSeno, general manager at Ofland Escalante (formerly Yonder), agreed. “We want people to explore nature without roughing it,” she said. She added that this is one of the reasons they have amenities that bring people outside, such as outdoor showers, campfires, and a drive-in theater.

Glamping, a portmanteau of “glamorous” and “camping,” first appeared as a word in the UK in 2005. Only recently, however, has it become popularized. Researchers at Murray State University (Kentucky) pointed out that the popularity of glamping was already on the rise by 2019, but the pandemic accelerated it.

Under Canvas is not the only glamping tent outfit serving the Bryce Canyon market, however. Just north of Cannonville, Wander Camp installed 24 glamping tents on a 40-acre parcel on the difficult side of the Paria River, and just across the highway to the west, REI built its canvas tent base camp.

These developments, along with Clear Sky and the recent openings of Bryce Camp & Glamp (geodomes) and the Bryce Valley Ranch RV and Horse Park, have made the outskirts of Cannonville the unintentional epicenter of tourism development.

Over-Supplied

Glamping may not directly compete with traditional lodging, but it does compete somewhat with many of the accommodations offered by the STR market. That is true even if they list their lodging on traditional booking sites rather than on Airbnb or VRBO. How much “supply” of lodging units can a market handle?

Even amateur developers got excited by the sudden post-COVID surge in travel demand in 2021. As a result, some areas become overdeveloped. Market data on STRs shows that regionally, the new supply of rentals has noticeably outpaced the growing demand from travelers. Many of those developments are just now coming online, even a year after lodging demand has settled.

Since July, 2021, three years ago, the total number of listed short-term rentals in Piute, Wayne and Garfield counties has increased 51%. And that’s just STRs — not units in glamping resorts or traditional hotels. And there are plenty more in the development pipeline.

Here is the three-year, percent increase in STRs in each of the local markets, plus Long Valley:

| Panguitch/Mountain: | 42% |

| Escalante/Bryce: | 52% |

| Piute: | 26% |

| Wayne: | 74% |

| Orderville/Duck Creek | 34% |

Wayne County takes the cake for the largest increase, and the majority of those STRs are in Torrey and Teasdale.

All these markets have seen substantial increases in STRs. At the same time, neither Bryce Canyon nor Capitol Reef national parks have fully rebounded to their pre-pandemic visitation levels.

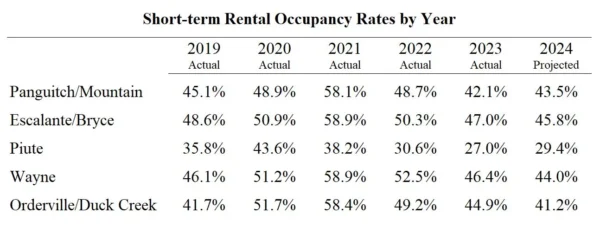

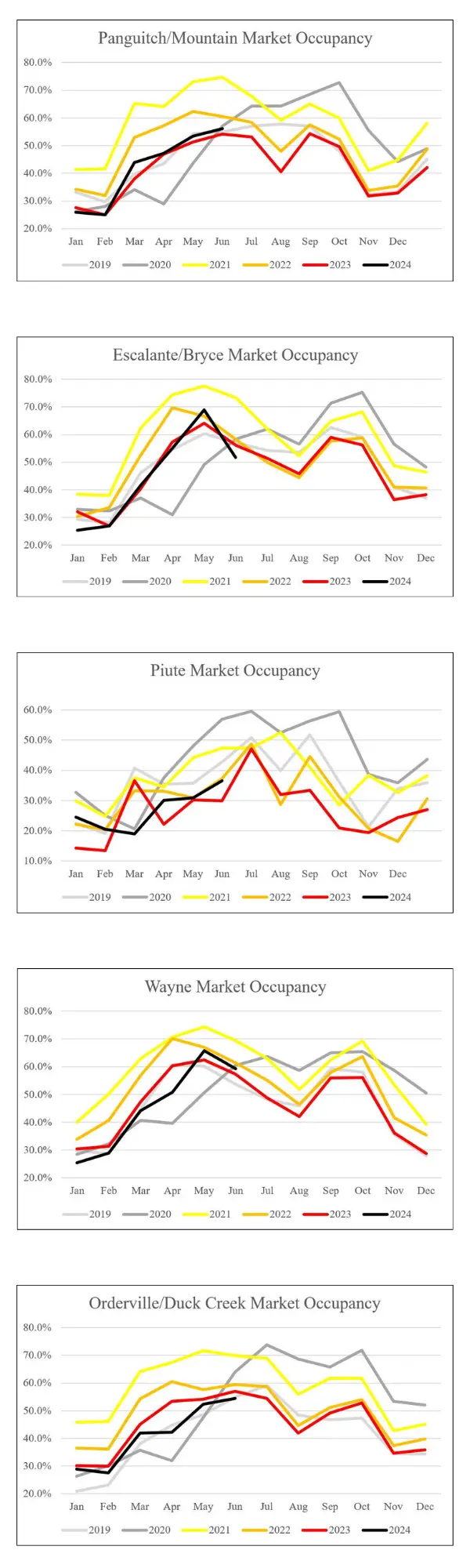

Occupancy rates show that demand has grown over the same period, but not by as much as the growth in supply. In the table with data provided by AirDNA, you can see the occupancy spikes for all markets in 2021, which induced a surge in new supply. Even with a substantial increase in STRs, however, occupancy has only decreased by a couple points from pre-pandemic levels.

in five markets. Data provided by AirDNA.

Still, the risk of oversupply is real, with more units in the development pipeline. When I asked the local glamping managers if they were worried about this, they largely shrugged it off. Caitlan Cullen at Under Canvas, for instance, felt that big players like Under Canvas and other professionally-developed resorts would have the effect of replacing many of the “mom-and-pop” rentals and other fly-by-night amateurs.

Linz DeSeno at Ofland Escalante noted that it’s impossible to control oversupply. “We don’t discuss [oversupply] a lot, but we just try to be the best option we can be,” DeSeno said. “But a rising tide raises all boats,” she added, in an expectation of further demand growth.

Looking to the Future

It’s always worse somewhere else though, and looking at other markets can help local governments and potential STR hosts stay on the path of smart growth.

Last November, Julie Satow, writing for the New York Times, told how one Oklahoma town was overcome with runaway growth by STRs.

“Airbnb built this town 100 percent,” said Dian Jordan, the mayor of Hochatown, Oklahoma. Hochatown, with a population of only 219, can see as many as 50,000 visitors on the weekends, most of whom are coming from Dallas, three hours away. Sounds familiar, right?

Satow wrote that before the pandemic, Hochatown had roughly 400 cabins available for rent, scattered through the pine forests. By the end of 2023, there were 2,400, even amid sinking demand.

In early 2023, the Hochatown rush began to slow and an area that had been over 90% booked saw occupancies slashed to 40% by August. “For sale” signs started popping up and houses that once took hours to sell, now took months. Many new hosts were forced to sell out.

Leo Winegar, who had purchased land to build a cabin at the end of 2021 was caught in the slowdown. By the time his cabin was built and ready to rent, the bubble had already burst, rendering his investment an instant loser.

“We scrimped and saved to buy a plot of land and get a construction loan,” Winegar told the Times. “At the time, the numbers were so amazing, it seemed like there was no way I could lose.” Winegar is worried he will have to sell his cabin.

There is nothing wrong with speculation, except that it comes with substantial risk. Locally, we aren’t suffering like the real estate investors in Hochatown, but that could still happen here.

Even with supply outpacing demand, there are still some good opportunities for STRs in our region, but investors need to carefully analyze the market to know what works. There is a lot of good data out there to show what type of assets will perform well, and what asset types are oversupplied. But for now, you should probably refrain from investing in studio-sized log cabins, geodomes, and tents. Let’s first see if the market has enough demand to absorb the ones that have already been built.

– by AJ Martel

Feature image caption: One of the tents available for rent at the newly-completed Under Canvas – Bryce Canyon resort just south of Widtsoe. Courtesy of Under Canvas.

AJ Martel – Escalante

AJ Martel is the youth coordinator at The Byway, but he is involved in most everything. He and his family live in Escalante, and they love it here! AJ has found Utah’s small towns quite inviting and under-defended, which is why he’s so involved with the paper. What AJ loves to do most, though, is serve his community. That is clear through everything he writes and does for Escalante, Utah.