This is an old news article from a previous year. The bills and other updates in this article are from Utah’s 2023 legislative session. To read about 2024, see 2024 Legislative Update.

The Utah Legislature has finished their work for the 2023 Legislative Session. They passed a total of 575 bills in the 2023 Session.

According to a press release sent out by Derrin Owens, who represents Garfield, Wayne and Piute counties, it was one of the busiest sessions held in the state.

Owens said in an email posted to constituents, “During the 2023 General Session, we worked to balance the state’s $29 billion budget, the largest budget in Utah’s history. This year’s extraordinary budget provided a generational opportunity for our state to invest in education, social services, water, housing, transportation, infrastructure, and cut taxes for the third consecutive year.

“The Beehive State is proof that, with responsible planning and fiscally conservative policies, states can provide economic stability and excel even through the most difficult circumstances.”

Owens is proud of the work they accomplished, especially the tax cuts that will help Utahns balance their budgets.

Budget Overview

Over the past two years the Utah Legislature has reduced taxes by nearly $300 million. To continue Utah’s commitment to reducing taxes and cultivating a family and business-friendly environment, the Legislature provided $850 million in tax relief for Utahns during the 2023 General Session.

The Legislature provided $850 million in tax relief:

- Reduced all Utahns’ income tax rate from 4.85% to 4.65%. A $380 million reduction in taxes. (HB-54)

- Expanded social security tax credit eligibility to individuals earning up to $75,000 per year. A $22.7 million reduction in taxes. (HB-54)

- Provided a tax benefit for pregnant women and for children one to three years old by allowing a double dependent exemption. A $13.1 million reduction in taxes. (HB-54 & HB-170)

- Increased the earned income tax credit (EITC) from 15% to 20%. A $1.2 million reduction in taxes. (HB-54)

- Removed the state portion of sales tax on food contingent on voters’ approval to remove the constitutional earmark for income tax revenue during the 2024 general election. A $211 million reduction in taxes. (HB-54)

- Lowered the state tax on gas by two cents per gallon. A $32.7 million reduction in 2024. (HB-301)

- Maintained the decreases of the basic property tax levy freeze, preventing a $146 million future property tax increase. In FY 2024, the basic property tax levy will decrease from .001661% to .001356%. (HB-293)

- Provided a low-income housing tax credit for Utahns. A $51 million reduction. (HB-364)

In Utah it’s imperative that we conserve water. In the past two years, we have allocated nearly a billion dollars for water conservation efforts and development, combating Utah’s water issues and planning for future growth. Bills were passed that allocated $500 million to address the diverse statewide water needs:

Budget Highlights for Water Conservation:

- $200 million – Agricultural Water Optimization

- $50 million – Water Reuse Reservoir and Desalination (SB-277)

- $50 million – Wasatch Front Aqueduct Resilience

- $30 million – Water Infrastructure Projects

- $25 million – Agricultural Water Optimization Loans for Matching Requirements

- $25 million – Dam Safety Upgrades

- $15 million – Secondary Water Meters

- $12.73 million – State Match for Drinking Water Revolving Loan Fund

- $10 million (one-time) and $2.5 million (ongoing) – Amendments Related to the Great Salt Lake (HB-491)

- $5 million (ongoing) and $7 million (one-time) – Cloud Seeding Program

- $8 million – Air and Water Innovation Grant

- $449,000 (ongoing) and $5 million (one-time) – Water Distribution and Measurement Automation

- $5 million – Utah Lake Improvements

- $4.4 million – Dam Safety Upgrades

- $2 million (one-time) $1 million (ongoing) – Utah Water Ways (HB-307)

- $1.8 million – Digital Lakebed Topography of Great Salt Lake and Bear Lake

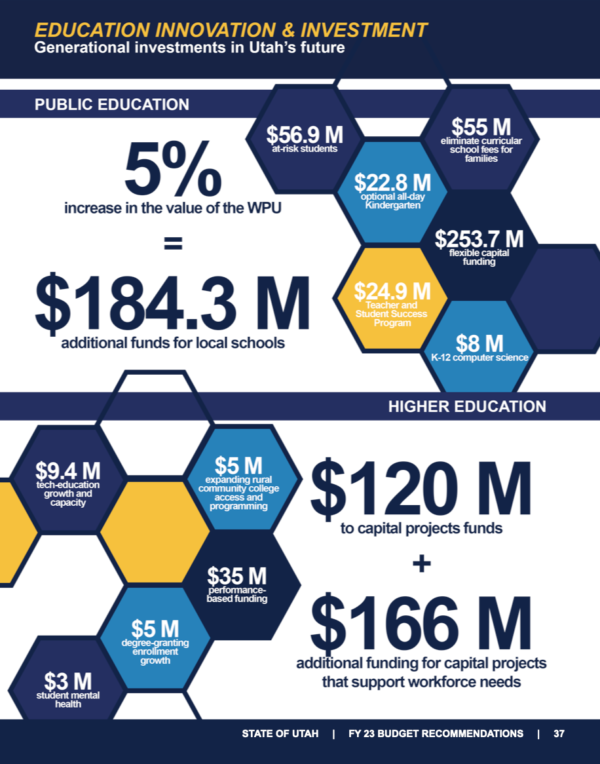

Budget Highlights for Public Education

- $440.6 million – Public Education Stabilization Account Available

- $239 million – Funding for Teacher Salaries and Optional Education Opportunities (HB-215)

- $236 million – 6% WPU increase (includes base budget increase of $132 million)

- $92 million – Permanent State School Fund

- $64 million – Educator Preparation and Collaboration Time

- $50 million – Small School Critical Capital Needs Fund

- $30 million – Flexible Funding WPU Distribution to 4th-6th Class County Schools

- $25 million (ongoing) and $586,500 (one-time) – At-Risk Students WPU Weighting Increase

- $17.9 million (ongoing) and $16.5 million (one-time) – Educator Salary Amendments (SB-183)

Budget Highlights for Education Programs

- $75 million – Flexible School Safety, Physical Facility, & Capital Needs

- $64 million – Educator Preparation and Collaboration Time

- $25 million – Optional Full-day Kindergarten Expansion

- $15 million – Teen Centers for Students Experiencing Homelessness

- $7.1 million – Grow Your Own Teacher and Counselor Pipeline

- $6 million – Pupil Transportation

- $1.69 million – Statewide Online Education Program Amendments – (SB-45)

- $1.2 million – First Lady’s initiative to “Show Up for Teachers”

Budget Highlights for Housing:

- $51 million – Utah Low-Income Housing Tax Credit

- $50 million – First-time Homebuyer Program (SB-240)

- $50 million – Deeply Affordable Housing

- $15 million – Teen Centers for Students Experiencing Homelessness

- $12 million – Homeless Services Dedicated Funding

- $10 million – Utah Housing Preservation Fund

- $7 million – Box Elder Crisis Shelter and Transitional Housing

- $5 million – Attainable Housing Grants

- $5 million – Shared Equity Revolving Loan Fund

- $4 million – Affordable Housing Technical Assistance

- $2.75 million – Rural Single-Family Home Land Revolving Loan Program

- $1 million – Critical Home Repair Program

- $500,000 – Veterans First-time Homebuyer Program

Budget Highlights for Infrastructure/Transportation:

- $800 million – UDOT Transportation Enhancements

- $775 million – High-risk debt reduction

- $200 million – Commuter Rail Improvements

- $150 million – Cottonwood Canyons Transportation

- $108 million – The Point of the Mountain

- $88.5 million – Highway 191 Safety Improvements

- $40 million – Rural B & C Roads (SB-175)

- $20 million – Wildlife Highway Mitigation

- $14 million – U-111 Connector Transportation Enhancements

- $6.9 million – County of the First-Class Highway Fund

Utah State Flag

Another controversial bill that was passed by the Utah State Legislature included the new state flag proposal. This bill seemed doomed to failure until the proponents made major changes to the bill.

Their first proposal was to do away with our state flag and have a completely new state flag that had been designed through widespread contests.

Opposition to the changing of the new flag was reported to be about 70% from surveys taken by Senator Evan Vickers of Southern Utah. Legislators asked why we were spending taxpayer dollars to print new flags when opposition was so high. Some revealed that the original idea had been proposed by a flagmaker who printed state flags.

In the end the legislature voted to keep the old flag as Utah’s historic state flag. Both flags may be flown on state and federal holidays. In addition, “all citizens maintain the right to use the historic state flag upon any occasion deemed fitting and appropriate,” the bill states.

Elections and Ballot Initiatives

“While HB-448 made relatively minor changes to elections in Utah,” ksl wrote, “the Legislature declined to pass several measures that would have had a more noticeable impact on future elections.”

“Republicans in Utah have felt a lot of angst recently over who can have a say in picking the party’s general election candidate,” the article continued. “A recent bill would have gutted the signature-gathering path to the primary ballot, effectively requiring all GOP candidates to show up and win over delegates at convention.

“Opponents of the bill said it would lead to more extreme candidates winning office, because convention delegates are widely seen as more ideological than the average conservative voter.

“HB-393 passed the House 43-26, but did not come up for a vote in the Senate before the session ended Friday.

“Similarly, lawmakers allowed the clock to run out on a proposed constitutional amendment that would have raised the bar for passing ballot initiatives that raise taxes.

“Currently, such initiatives can pass with a simple majority vote, but HJR-17 would have asked voters to approve increasing the threshold to 60% of voters.

“The resolution passed the House 56-16, but wasn’t considered in the Senate.”

Lawmakers approved a different effort sponsored by Rep. Michael Petersen, which would increase the penalty for tampering with ballot drop boxes. HB-347 would make drop box tampering a third-degree felony — up from a class A misdemeanor — punishable with up to five years in prison and fine of up to $5,000.

– by Elaine Baldwin

Feature image caption: The Utah capitol building at sunset. Stock image.

Elaine Baldwin – Panguitch

Elaine Baldwin is an Editor/Writer for The Byway. She is the wife of Dale Baldwin, and they have three children, 11 grandchildren and one great granddaughter. Elaine enjoys making a difference in her world. She recently retired after teaching Drama for 20 years at Panguitch High School. She loves volunteering and finds her greatest joy serving in the Cedar City Temple each Friday.